CIMdata Reports Global cPDm Market Will Top $2.2 Billion in 2000

The worldwide collaborative Product Definition management (cPDm) market grew 26% to reach $1.76 billion in 1999, according to figures released today from consulting and research firm CIMdata Inc (Ann Arbor, MI). The firm predicts the market will top $2.2 billion in 2000 and increase at a compound annual growth rate (CAGR) of 20% through the year 2004, when the market size is expected to exceed $4.4 billion.

CIMdata attributes the high growth in 1999 to continued broad adoption of the technology throughout enterprises and increased sales of systems representing new technologies entering the market. "The traditional roots of product data management are based in design engineering," explains Ed Miller, president of CIMdata, "but web-based systems and related technologies focused on e-business initiatives are broadening the scope of PDM, which is now moving closer toward the vision of an enterprise-wide infrastructure."

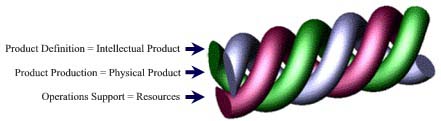

Miller explains that the broadened scope in the market represents its next evolutionary step referred to as "collaborative Product Definition management" (cPDm), which includes newer solutions beyond traditional PDM that facilitate collaborative work processes such as visualization and collaboration, enterprise application integration technologies, and web-based approaches.

E-enterprise friendly

cPDm enables industrial organizations to bring innovative and profitable products to market more effectively especially in the e-business environment. According to Miller, "cPDm is a strategic business approach, applying a consistent set of business solutions to collaboratively manage the product definition lifecycle across the extended enterprise." This is achieved through a combination of best-practices processes and a full suite of technologies such as product data management, collaboration, visualization, collaborative product commerce, enterprise applications integration, components, and supplier management, among others.

Miller says that the need to manage product definition and associated processes is growing even more acute. "The globalization of companies has dispersed employees, products, services, and partners around the world. Additionally, product content can take on a variety of forms that take much more effort to manage than their predecessors. On top of this, Internet and Web-based technologies are making information from both inside and outside of the organizations quickly available to widely dispersed operations," Miller explains.

"Products based on these technologies are entering the market rapidly and helping companies tremendously in the complete product definition throughout the extended enterprise," notes Miller. "The ability to capture and manage an enterprise's intellectual assets throughout the product definition lifecycle greatly differentiates cPDm solutions from other approaches, and contributes to their growing importance and adoption in industry as a way to manage information within companies as well as in supply chains and other extended enterprises."

According to Miller, this year's market statistics reflect activity in this newly named cPDm industry but are consistent with figures from previous years, which included the same types of products and services. The statistics are provided as part of the CIMdata Market Service that keeps subscribers apprised of the latest trends, events, and issues surrounding the rapidly changing cPDm industry.

CIMdata ranks the vendors

"A wide range of vendors supply software and services to the cPDm market," explains Patrice Romzick, CIMdata Market Analyst. "Some offer large-scale, fully functional implementations, while other vendors supply low-end or mid-range systems. Yet others focus on specific application areas such as document management, visualization, or component supplier management." Romzick says that as a result, the overall cPDm market comprises different sub-segments with their own set of specific suppliers, many of which do not directly compete but rather complement one another. She expects this segmentation to increase in the coming years.

Software and services market leaders

According to CIMdata statistics, the market leader for the broadscale cPDm software and services market is Metaphase Technology, a division of Structural Dynamics Research Corporation (SDRC) with a market share of 8%. It is followed by PTC with 7%; IBM/Enovia with 6%; Documentum, and Aspect Development, each with a 5% share. SAP AG and Engineering Animation Inc. (EAI) follow with 4% shares; and Unigraphics Solutions, MatrixOne, and Siemens Business Services (SBS), a jointly owned subsidiary of Siemens AG and Siemens Nixdorf Information Systems, each capture a 3% market share. Service-only vendors are not included in this group.

Software only market leaders

Based on sales of cPDm software only, the overall top ten vendors are PTC with an estimated 10% share; both Documentum and EAI with 8% shares; Metaphase/SDRC and Aspect Development, each with 7% shares; IBM/Enovia, Unigraphics Solutions and SAP AG, all with 5% shares; MatrixOne Inc. with 4% and Agile Software Corporation with a 2% share.

PDM-centric system market leaders

CIMdata also compiles market figures for extended enterprise PDM-centric system vendors—the core of the cPDm market including solutions such as Collaborative Product Commerce (CPC), Product Content management and Product Lifecycle Management. These vendors offer systems that embed primary PDM functionality and have demonstrated scalability, whose products can be distributed across broad networks, and have a track record of selling their products for use throughout extended enterprises.

Leaders in this market are Metaphase/SDRC with a 14% share and both PTC and IBM/Enovia with a 12% share. SAP AG follows with 8% and Unigraphics Solutions and MatrixOne Inc, each have a 6% share. Intergraph Corporation, NEC Corporation, Eigner + Partner AG and Agile Software Corporation each have a 3% share of this market.

Based on sales of high-end PDM-centric software only, the overall top ten vendors are PTC with a 19% share; Metaphase/SDRC with 14%; IBM/Enovia and Unigraphics Solutions each with a 10% share; and SAP AG with 9%. MatrixOne Inc. captures a 7% share, while Agile Software Corporation has a 4% share. Both Baan Company and Eigner + Partner AG each have a 3% share and Quillion Group Ltd. has a 2% share.

Global growth

Geographically, the largest cPDm market segment remains North America. In 1999, 47% of the worldwide cPDm investments came from companies in North America, where most of the early implementations occurred and where a growing number of companies are investing heavily in extensive second-generation systems. European cPDm investments remained at 38% of the world market in 1999, with European cPDm investments increasing in line with the overall market.

The Asian-Pacific market share was 14% of the total worldwide cPDm market, maintaining its 1998 share. "The Asia-Pacific region continues to show healthy growth, however, and has a strong market potential, particularly in areas such as Japan and Korea where major manufacturers are investing heavily in cPDm and an increasing number of vendors are establishing sales facilities and support centers," says Romzick.

Industry segment growth

Worldwide market growth is driven primarily by sizable investments in cPDm by large manufacturing firms. In 1999, the transportation industry led all other industry sectors with a 22% share with the electronics and telecommunication industry following close behind with a 21% share of cPDm investments. According to CIMdata, cPDm is used by electronics companies in managing extremely short product lifecycles and meeting rapid time-to-market demands for products such as computers and telecommunications equipment. The aerospace industry accounts for 16% of the cPDm market and continues to invest heavily in cPDm.

Process and utilities industries contribute 14% of the cPDm market at petroleum, chemical, food, pharmaceutical, and other process sectors as well as utility companies in electrical, gas, and water distribution. Many of these companies use the technology mainly for asset management associated with the design, construction, and maintenance of huge projects and facilities.

Manufacturers of heavy machinery such as machine tools, construction equipment, and agricultural machinery accounted for 14% of cPDm revenue, while another 8% was contributed by other discrete manufacturing companies using cPDm in the design and manufacturing of consumer products, recreation equipment, home appliances, office equipment, business machines, and metal parts.

Romzick notes that in all these sectors, more than 60% of the expenditures for cPDm are devoted to software-related services, with a focus on integration of related systems and technologies. She also points out that total market figures for cPDm represent only a small piece of what companies actually spend in implementing the technology and do not reflect required investments in critical areas such as hardware, computing infrastructure, business process re-engineering and organizational consulting.

April CIMdata cPDm conference

Information on the cPDm market, technology, and applications will be presented at the annual conference April 11th-13th, 2000, hosted by CIMdata in Palm Springs, CA. The event is the world's largest exposition totally focused on solutions to manage the full product definition lifecycle in the extended enterprise. More than 1,200 delegates are expected to attend. Over 40 solution suppliers will demonstrate products and services in an exhibit hall and schedule individual meetings in private suites. One day of tutorials presented by CIMdata consultants will be followed by two days of presentations by user companies describing their applications. Discussion groups allow attendees to share experiences. The conference is tailored to meet the needs of individuals and organizations that are responsible for supporting the definition, purchase, production, and maintenance of product or plant. Cost is $995 for the two-day conference and an additional $400 for the one-day tutorials.

CIMdata Inc, 3909 Research Park Drive, Ann Arbor, MI 48108 USA; phone: +1 734 668-9922. Fax: +1 734 668-1957